If you are a Moog employee, you know the company changed its retirement plan at the start of 2020. The change was not unexpected: like many in the industry, Moog shifted from a traditional pension system (with payments guaranteed), to a now more common defined contribution plan (where the payments are not guaranteed and market risk is assumed by employees).

As part of that new plan, Moog created the RSP+ account.

What is the RSP+ Account?

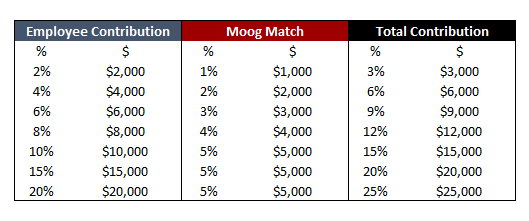

Moog’s new retirement plan includes both a company match on employee 401(k) contributions as well as a direct retirement contribution. The direct retirement contributions are not a match (employees don’t have to contribute to receive the payments) and take into account both an employee’s age and salary: those ages 39 or younger receive 3% of compensation, ages 40-49 and ages 50+, receive 4% and 5%, respectively.

For example, a 52-year old Moog employee making $100,000 per year, receives an annual direct RSP+ contribution of $5,000.

How are RSP+ accounts invested?

While the default option for Moog employee 401(k) accounts (including the company match) is the Blackrock LifePath funds (you can read our review of the LifePath funds here: “

Moog Employees: Are you Making the Most of your 401(k) Account?”), the

default option for the direct retirement contributions is 100% in Moog stock.

As a Moog employee,

you have the option to change how your RSP+ account is invested at any time (including the direct retirement contribution). The RSP+ plan offers a wide range of diversified index funds (such as those tracking the S&P 500) to choose from instead.

However, as of September 2020, Moog employees still own

$98 million in company stock.

I haven’t changed my investment election and am still receiving Moog stock. What should I do?

The chart below shows the performance of Moog Stock (green) versus the S&P 500 (blue) over the last ten years. Moog has significantly underperformed the S&P 500, returning 114% versus the S&P’s 350%.

Put another way, $10,000 invested in Moog stock ten years ago would be worth $21,400 today. That same $10,000 invested in the S&P 500 would be worth $45,000 today.

It’s not just about returns, too. It’s also about risk. Moog stock has been significantly more volatile than the S&P 500 over the last ten years, including drops of 50% in 2016, and nearly 70% in 2020. In fact, over the last ten years, Moog has capture just 91% of the market’s upside, but 178% of the downside.

While we believe there are many benefits to employees owning stock in Moog, we believe it’s equally important for employees to remain diversified.

How can we help?

If you are a Moog employee and are currently thinking about retirement, we have a plan for you. Ogorek Wealth Management (based in Buffalo, NY) specializes in managing wealth and building retirement plans for Moog employees. We are experts in your benefits plans and will work to give you a seamless transition into retirement.

Learn more about Ogorek Wealth Management and our unique approach by scheduling a time to meet.

Gain comfort in one of the most important decisions in your life.

It’s not just about returns, too. It’s also about risk. Moog stock has been significantly more volatile than the S&P 500 over the last ten years, including drops of 50% in 2016, and nearly 70% in 2020. In fact, over the last ten years, Moog has capture just 91% of the market’s upside, but 178% of the downside.

While we believe there are many benefits to employees owning stock in Moog, we believe it’s equally important for employees to remain diversified.

It’s not just about returns, too. It’s also about risk. Moog stock has been significantly more volatile than the S&P 500 over the last ten years, including drops of 50% in 2016, and nearly 70% in 2020. In fact, over the last ten years, Moog has capture just 91% of the market’s upside, but 178% of the downside.

While we believe there are many benefits to employees owning stock in Moog, we believe it’s equally important for employees to remain diversified.