When is the best time to commence benefits? Examining the breakeven point for delaying benefits versus your life expectancy may provide some clues.

Breakeven Point

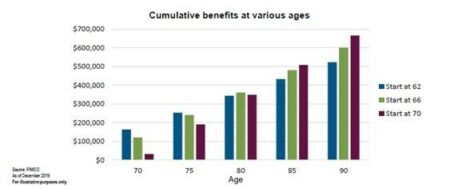

At what age will you break even and come out ahead if you delay Social Security?

The chart above shows total lifetime benefits based on the age you started receiving benefits. You’ll notice that at age 80, cumulative benefits are pretty close, no matter the age that you started claiming benefits. Most breakeven points are somewhere between ages 78 and 83. Now that we know that the question becomes: “What are the odds I will outlive the breakeven point?”

Life Expectancy

Social Security is designed with “actuarial neutrality,” meaning that no matter when you choose to claim benefits, you should receive about the same amount of total benefits over your lifetime. However, the Social Security life expectancy tables are based on the entire U.S. population, and don’t project mortality rates into the future, which can be misleading.

We prefer to use life insurance industry mortality tables which project mortality rates into the future. They also consider more factors, such as health, family medical history, and occupation, to name a few. Using the life insurance table projections, average life expectancy is 88 years old, which is more than 5 years longer than the latest breakeven point in our Social Security analysis. Comparing a Social Security breakeven analysis with insurance mortality tables favors (for most people) delaying benefits to age 70.

Married couples should think about the survivor benefit. Upon the first to die, the surviving spouse is entitled to the deceased spouse’s benefits (assuming the deceased spouse is the higher earner). Claiming benefits earlier reduces the amount the surviving spouse is eligible to receive.

While we can model a wide variety of scenarios for our clients, the condition of their health can be a major determinant in whether they choose “a bird in the hand, rather than two in the bush.”

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.