Update: Congress reached a deal in early October to raise the debt ceiling through December. While this action avoided the first-ever default of U.S. debt, it merely kicked the can down the road. Democrats and Republicans remain very far apart on a longer-term solution.

The U.S. faced a debt ceiling crisis very similar to today ten years ago. While the U.S. avoided default in 2011, the brinkmanship between parties (a Democratic White House and Republican Congress) led to the first-ever credit downgrade of the United States (the culprit was S&P, who downgraded the U.S. several days after an agreement had been reached).

In explaining its decision, S&P wrote: “The political brinksmanship of recent months highlights what we see as America’s governance and policymaking becoming less stable, less effective, and less predictable than what we previously believed. The statutory debt ceiling and the threat of default have become political bargaining chips in the debate over fiscal policy. Despite this year’s wide-ranging debate, in our view, the differences between political parties have proven to be extraordinarily difficult to bridge…”

As a reminder, this paragraph is from 2011, not today. The parallels to today, however, are striking.

- We are a year or so removed from a recession (2011: Great Financial Crisis, 2021: COVID).

- Extraordinary (though necessary) fiscal stimulus in response to each recession left us with ballooning national debt.

- The debt ceiling (which is typically raised on a bipartisan basis without ceremony) has been turned into a point of debate. For the record, raising the debt ceiling does not authorize new spending, but merely allows the treasury to pay for spending already approved.

2011: What Can We Learn?

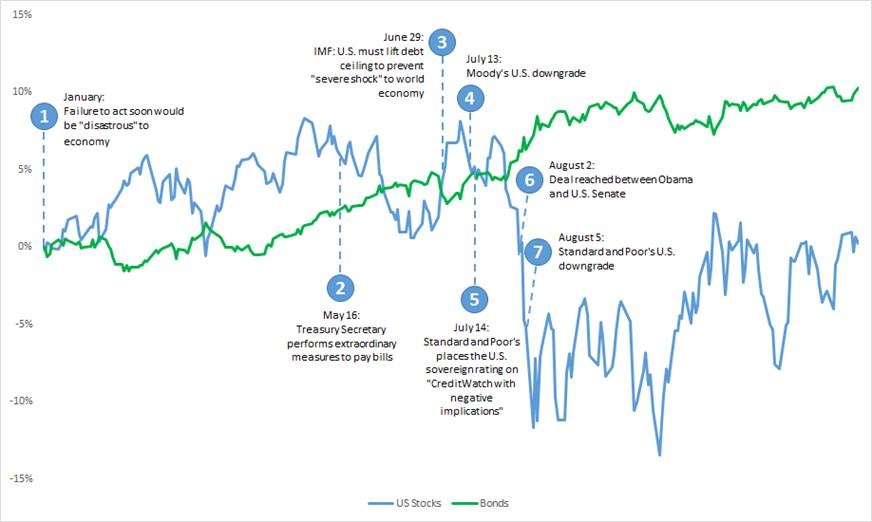

- Despite the Treasury Secretary’s warning of “disaster” in January, it took eight more months before Democrats and Republicans made a deal. Deadlines create action: Don’t expect a resolution until the last possible second.

- Treasury bonds did remarkably well throughout the year. Despite being downgraded and the U.S. on the brink of default, Treasury bonds were still viewed as the “safest” investment. Your bonds should still act like bonds throughout this crisis, and provide ballast to your portfolio.

- Stocks reacted with near-term volatility as the deadline approached (and fell a further 5% on the day S&P downgraded the U.S.). However, stocks quickly recovered and ended the year in positive territory. We would look at any similar bout of volatility as a buying opportunity for your portfolio.

While this year’s crisis will not play out exactly like 2011, we believe history will provide a useful guide in this case.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.

Comments:

Sister Emily Bloom October 05 2021