It wasn’t that long ago that the market fell out of love with the Big Tech IPO. In May of last year, Uber Technologies priced its IPO at the low-end of its expected range, and the shares still fell more than 7% on their first day of trading. The shares then fell by another 30% over the next two months. WeWork (leader in shared workspaces) suffered an even worse fate, as the company was forced to pull its IPO altogether amid weak demand.

In an otherwise strong year for the stock market, ambivalence about the IPO market was seen as a good sign. The market wasn’t willing to buy these so-called “unicorns” – with billion dollar valuations but no clear path to profitability – for just any price. While stocks were booming, this proved the market was perfectly rational.

Fast forward to today, and we may be seeing a different story. This week, despite pricing at well above their expected range, DoorDash and Airbnb still climbed by nearly 100% in their first day of trading. Doordash (meal-delivery app) is now worth roughly $58B, nearly double YUM brands, which owns Taco Bell, KFC and Pizza Hut. Airbnb (vacation rental app) is worth $78B, more than Marriot, Hilton and Hyatt, combined.¹ Neither Doordash nor Airbnb is profitable.

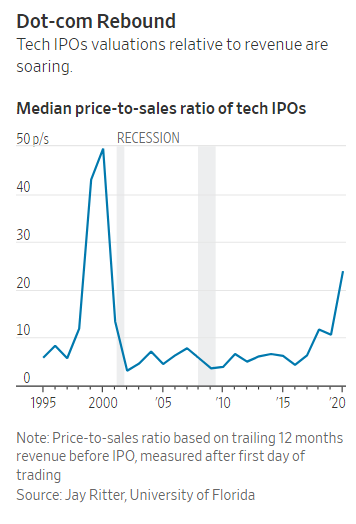

Tech IPO valuations, in general, are prompting concerns of a return to the dot-com era. According to the Wall Street Journal, Tech IPOs this year are trading at nearly 24x sales, the highest level in nearly two decades (see the chart below). In the last decade, Tech IPOs averaged just 6x sales, with the average NASDAQ firm currently trading at just over 4x sales.

What does this IPO mania mean for the rest of the market? In a year that has largely defied expectations (with stocks now up more than 15% despite a once every-hundred years pandemic), investors are rightfully worried about bubbles. The IPO market, for one, isn’t helping.

- Source: Wall Street Journal (“Sizzling Tech IPO Market Leaves Investors Befuddled”)

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.