We are now 34 days away from the election and the first debate is on the books. While we aren’t sure which way the election will go (Biden is ahead in the polls, but so was Clinton in 2016), the outcome will almost certainly move the markets.

How do we prepare for this uncertainty? Who will be the winners and losers in the stock market if Biden or Trump wins?

A Look Back at History

Presidents have many levers they can pull to influence the economy, including taxes, spending, and regulation. But it’s important to note that they can’t pull all the levers. For starters, it matters who controls the House and Senate. A president that has the opposite party in control of Congress has little chance of passing any significant legislation. And then there is the Federal Reserve, which independently sets interest rate policy. It can be argued that no institution (not even the Executive Branch) is more important than the Fed when it comes to the economy and the stock market.

It’s not that the President doesn’t impact the economy. It’s that the President impacts the economy a lot less than you probably think.

Case in point, President Obama and President Trump couldn’t be more different in economic policies. Tax policies, regulations, environmental protections. You name it, and they are very far apart.

However, look at how the stock market reacted during their terms. They are both above historical averages. Returns averaged 15.5% per year under Obama, 13.4% for Trump. The constant during their terms was rock bottom interest rates set by The Federal Reserve.

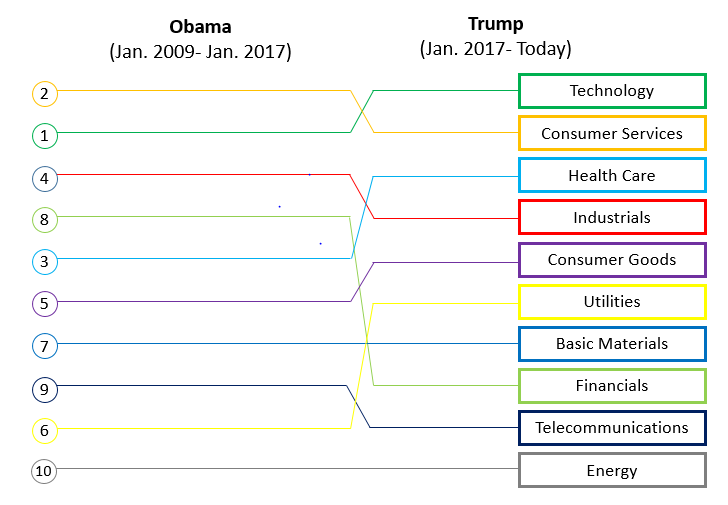

The stock market returns are even similar by industry. The chart below ranks the top performing industries under Obama (left) versus Trump (right). Notice that they are nearly identical. Technology, Consumer Services, Health Care and Industrials were in the top 5 under both Obama and Trump. Basic Materials, Energy, Utilities and Telecommunications were in the bottom 5 under both Obama and Trump.

Financials is the outlier. When Trump was elected, Financials shot higher as the market anticipated fewer regulations and tax cuts. While those did indeed happen, Financials have been one of the worst performing sectors under Trump. Why? Because interest rates fell (see Federal Reserve) and bank profits got squeezed.

Trump vs. Biden

Our analysis is a reminder that the President is not the sole determinant for how the economy and stock market perform. In other words, the election of Biden or Trump will not be reason to sell all your stocks, or conversely, go on a buying spree. In a charged political climate, it’s more important than ever to stay level-headed and not overreact one way or the other.

That said, the election will have consequences for the markets, and likely will create some “winners” and “losers”. We believe this will primarily relate to differences in tax policy between the candidates.

In our blog next week, we’ll detail Biden’s tax plan and the implications for your portfolio and tax bill. We’ll also look at the big winners following the passage of the President’s tax cuts in 2017 for clues as to the big losers should the tax cuts be reversed.

While the election will clearly be a market-driving event, remember that the major reason the stock market is higher this year (intervention by the Federal Reserve in the form of very low interest rates) will remain in effect next year no matter the outcome of the election. Regardless of who is President come inauguration day, the stock market can still go higher next year.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.