In response to the pandemic, the Federal Reserve has forced interest rates to their lowest level in history. 10-Year Treasury bonds currently pay just 0.60%. Money market accounts pay next to nothing. With yields so anemic, investors (and savers) have looked elsewhere for better returns, and instead, pushed money into high-growth stocks such as Amazon and Apple (each up more than 70% year-to-date), and even gold (up 27%). Simply put, the money has to go somewhere.

But curiously enough, the money is not going to dividend-paying stocks. The Vanguard High Dividend ETF (which currently offers an attractive 3.6% yield) is down 10% for the year. With bond yields so low, why aren’t investors turning to dividend stocks for income?

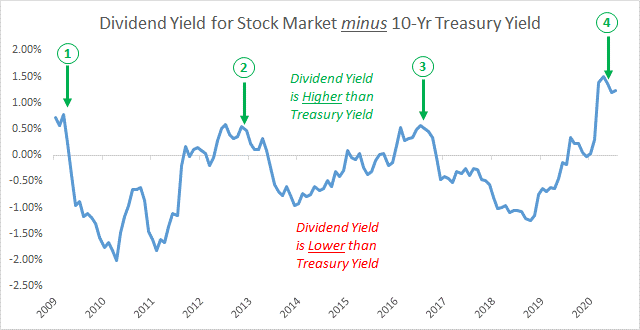

The chart below shows the dividend yield for the stock market as whole minus the 10-Treasury bond yield, dating back to the Great Recession. The dividend yield for the stock market is currently 1.9%, versus just 0.6% for 10-year Treasury bonds. You can see in the chart that this is the greatest difference between dividend yields and Treasury yields (1.3%) since the Great Recession. What you can’t see in the chart is that this is also the greatest difference in at least the last 45 years!

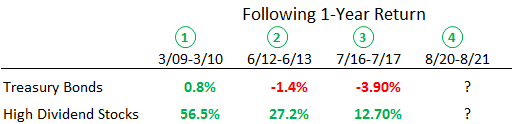

In fact, until this century, it was rare for the dividend yield on stocks to be higher than the 10-year Treasury bond yield at all. We’ve marked three such occasions on the chart (excluding today), since the Great Recession. In the table below, we show you what happened next.

In each of the three time periods (when dividend yields were higher than Treasury yields), high-paying dividend stocks vastly outperformed bonds over the following year. What’s more, high-paying dividend stocks outperformed the stock market as a whole in two of the three time periods. Does this spell good news for high-paying dividend stocks moving forward?

While only time will tell, we believe the rush into riskier assets (tech stocks and gold) may prove fleeting. And we now believe there is a compelling case for investors to turn to high-paying dividend stocks to boost the income of their portfolios. Potentially, even replacing a modest portion of their bond portfolio.

However, this is not the end of the story. In our next blog post in this series, we’ll explore why “all dividend-paying stocks are not created equal.”

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.