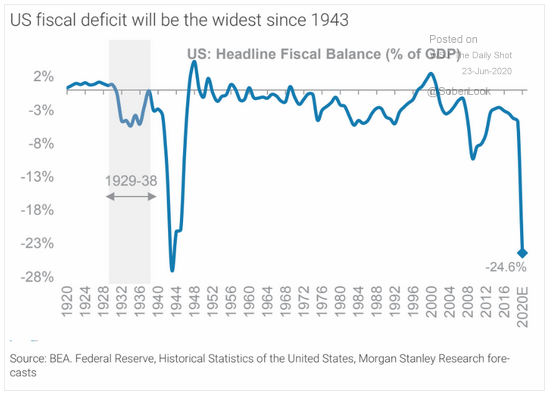

Covid-19 has been likened to a war by the president, the governor of NY and many other political leaders. The response so far by the federal government has largely backed that up, with the federal deficit expected to be the largest (relative to the size of our economy) since 1943, then in the midst of World War II. As you can see from the chart below, U.S. government spending during the current crisis has made even the Great Recession of 2008 look like an example in fiscal restraint.

All told the U.S. government (including the Federal Reserve) spent $6 trillion so far to support the economy. This includes the Payroll Protection Program (expiring June 30), additional unemployment benefits of $600 per week (expiring July 31), and sending individuals $1,200 stimulus checks (either already spent or in consumers savings accounts). The government essentially wrote a blank check to the U.S. economy with the singular goal of getting us through the worst of the pandemic.

For a while, with the virus in retreat and stay at home orders lifted, that seemed to be enough. Mission Accomplished.

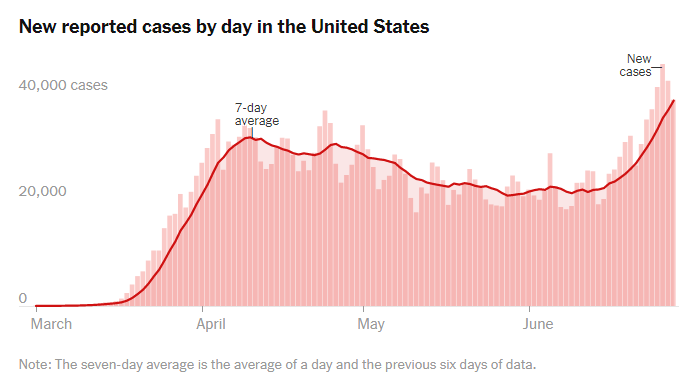

But things have changed recently, as the virus’ retreat in the Northeast has been matched by an equally strong rise in the South and Southwest, with new daily reported cases for the U.S. touching all-time highs (see chart below).

Source: NY Times

This begs the question, what if we haven’t seen the worst of the pandemic yet? If the virus continues to spread, does the U.S. government have any more cards left to play?

We’ve spent $6 trillion dollars so far, which by and large sustained the economy and households for about 3 months. With most of the programs expiring, leadership in this country faces a real challenge about how far it can go (and should go) to bail out the U.S. economy.

Capitalism has historically been about risk and reward. It morphs into something else with unlimited bailouts for businesses and stimulus checks. As Covid-19 transitions from short-term crisis to one that seems to have real staying power, the government leaders will have to make some tough choices. And those choices could have a big impact on the markets and the economy going forward.

Contact us if you’re looking for help with your financial planning!

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.