This is a question we ask ourselves daily as we try to determine when is the right time to rebalance your portfolios. Rebalancing means re-positioning portfolios back to their target allocation by way of selling bonds (which are positive for the year) and buying stocks.

It may seem as if things couldn’t possibly get worse for stocks, with the market now off 30% from its high, but the truth is that this bear market is still pretty benign relative to previous ones.

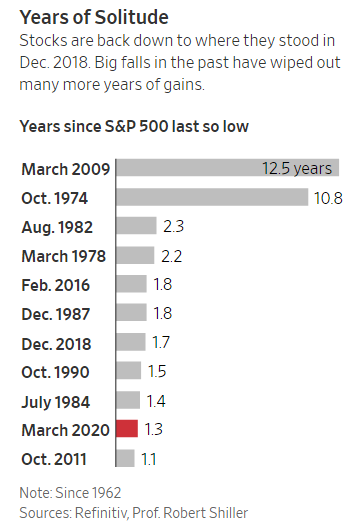

The chart below shows the number of years in gains given up during this bear market versus previous ones. While the market’s current free-fall has been jarring, we are still just back to December 2018 levels. In other words, investors have given up just over a year of gains so far in the current downturn. During previous downturns, investors gave up much more, such as the Great Recession (13 years) and the 1974 oil crisis (11 years).

In some ways, this should give you comfort:

- Long-term investors (which we are) are still in relatively good shape after this downturn because the gains last year were so great (2019 was a terrific year for stocks).

- Last year’s market gains were strong in part because the U.S. economy remained strong. With the U.S. economy in good shape before the virus hit, we feel it is in a better place to withstand the economic fallout. One example would be banks, which were in excellent shape when this virus hit and therefore are likely to avoid any sort of financial crisis (as we saw in 2008).

However, in another way, this chart may be giving us a heavy dose of reality: That stocks still have a lot further to fall based on history. In other words, things may get worse before they get better.

While we believe we are likely not yet at the bottom, there is reason for hope. The Fed has lowered interest rates to zero and committed to a large bond buying program (following its playbook from 2008). However, this crisis is not a financial crisis, and the market has largely shrugged at the Fed’s actions. That said, we think a large fiscal stimulus plan that supports businesses and individuals would blunt the hit to the economy from quarantine measures and would be viewed positively by the markets. With the Government beginning to wake up to the severe economic impact the virus is having, we believe such a fiscal stimulus is likely to happen eminently.

The truth is that there is no playbook for the current situation. We have never experienced a viral outbreak of such rapidity and scope and are just beginning to understand the consequences. However, long-term investors should take comfort that stocks have always recovered from previous downturns. Staying the course, especially when everyone else is panicking, has proven to be the winning strategy over time. As always, contact us with any questions or concerns you may have.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.