In just seven trading days, the S&P 500 went from an all-time high to now down 15% (incredibly, we are just 5% away from the first bear market since 2008). While the virus has yet to spread widely in the U.S., that outcome is now considered inevitable, and incidence of the virus has been steadily increasing throughout Europe, Japan, and the Middle East. While there is no “playbook” for dealing with an exogenous event such as the Coronavirus (from a financial perspective), we can draw some conclusions from past “contagions.”

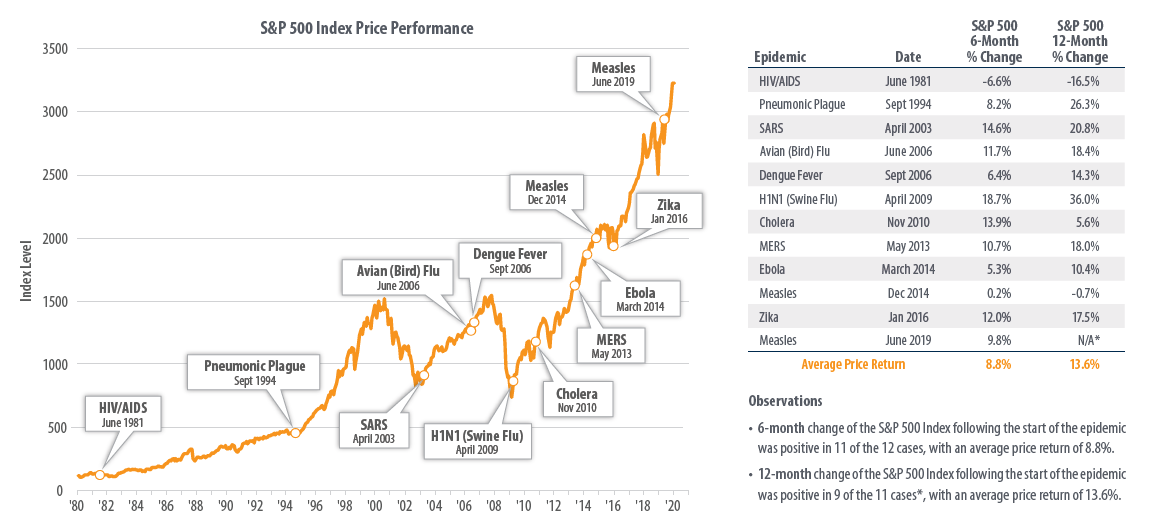

The chart below shows the S&P 500 index performance during previous epidemics, including SARS (2003), H1N1 (2009) and Ebola (2014). As you can see, in all but one case, the S&P 500 was higher six months after the start of an epidemic, and higher after 12 months in all but two cases. The average gain for the S&P 500, 6 and 12 months after the start of an epidemic, was 9% and 14%, respectively.

Source: First Trust Portfolios L.P.

However, while the market’s proven resilient to these epidemics in the medium to long-term, that doesn’t mean there wasn’t some pain immediately. In fact, the S&P 500 fell 13% during the height of the SARS outbreak in 2003, and 13% during the Zika outbreak in 2016. However, in both cases, the market eventually recovered. We believe a similar outcome is likely here, with markets continuing to take a hit in the short-term, but recovering once panic resides.

Our approach going forward will be two-fold. For those of you drawing on your accounts, we will use this opportunity to sell bonds, rather than stocks. We have kept our bond portfolio high quality for just such an occasion, and your bonds are up nearly 3% for the year. For those of you not drawing on your accounts, we may rebalance your account back to your target weight (selling bonds, buying stocks) if we see the market bottoming. Rebalancing your account after big swings in the stock market (up or down) has proven to be a winning strategy over the long term as it forces you to buy low and sell high.

Please do not hesitate to contact us with any questions. While big declines in the market can be jarring, we believe staying focused on the long-term and maintaining a diversified portfolio of stocks and bonds, is the best way to grow and preserve your assets over time.

For more information, check out the First Trust Article: Is It Time to Fear the Coronavirus?

Related article: Stocks Tumble on Coronavirus Fears

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.