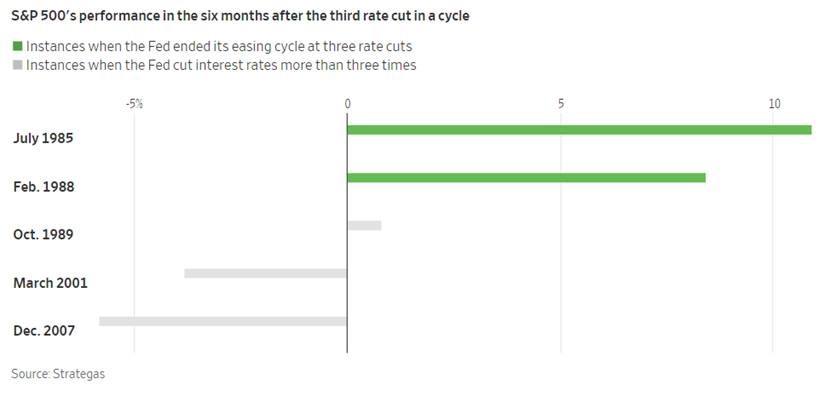

The Federal Reserve began lowering interest rates this year and has now done so a total of three times (with the latest cut just days ago). The graphic below from the Wall Street Journal shows how the stock market has fared in the six months following a string of three rate cuts.

As you can see below, the market’s performance depends heavily on whether the third cut is the Fed’s last, or whether additional cuts soon followed. In 1985 & 1988 (green bars), the Fed cut rates three times and then stopped, and the stock market rallied significantly in the months that followed. In 1989, 2001 and 2007 (grey bars), the Fed cut rates three times and then several times more after that, and the stock market was either flat (1989) or sharply lower (2001 and 2007) six months after. The reason? Three cuts by the Fed could be seen as precautionary, attempting to prevent a recession from occurring. More than three cuts likely spells trouble, meaning the Fed was trying to get the economy out of a recession that had already begun.

Only time will tell whether the recent third rate cut will be the Fed’s last. But if it is, that could mean good news for the markets.

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.