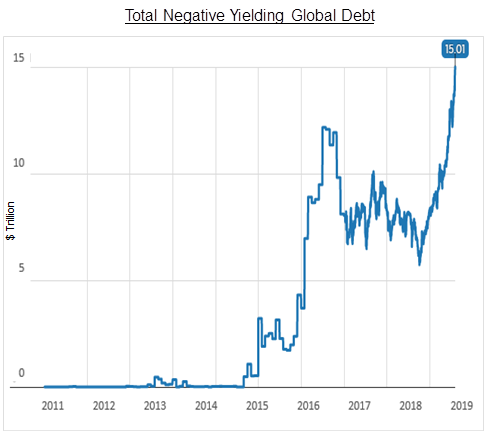

The U.S. 10-Year Treasury Yield has been cut in half since the fourth-quarter last year (3.2% –> 1.6%), causing bond prices to rise significantly (taxable bond index is up nearly 9% year-to-date). The primary culprit is negative yields outside the U.S., which causes U.S. yields to look more attractive by comparison. There is currently $15 Trillion of negative yielding debt globally, nearly triple the amount at the end of last year.

Source: Deutsche Bank, via CNBC

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.