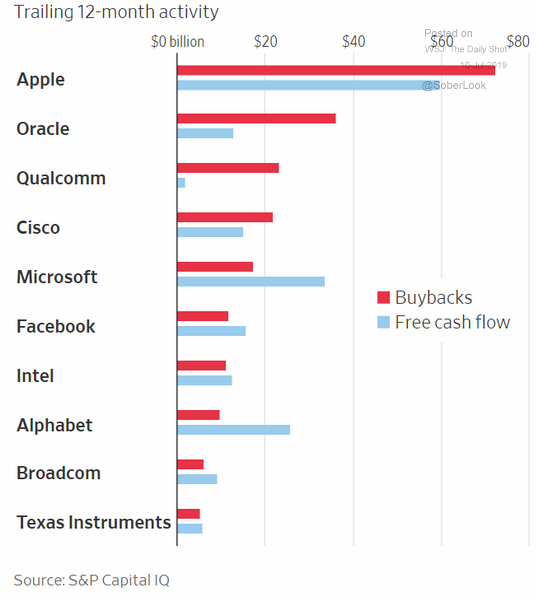

U.S. companies repurchased $800 billion worth of their own stock last year (an all-time record) and an additional $200 billion in the first quarter this year. Leading this trend are major technology firms (such as Apple, Oracle and Qualcomm) which are flush with cash and eager to reduce their number of shares outstanding, and thus increase their earnings per share.

The chart below shows that the current pace of buybacks may prove unsustainable, as many tech firms are spending more on buying back stock than they currently generate in free cash flow. Buybacks are considered a major driver of the market’s recent returns, and so it’s important to consider the impact to the market when the well runs dry.

Source: S&P Capital IQ (via Daily Shot WSJ)

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.