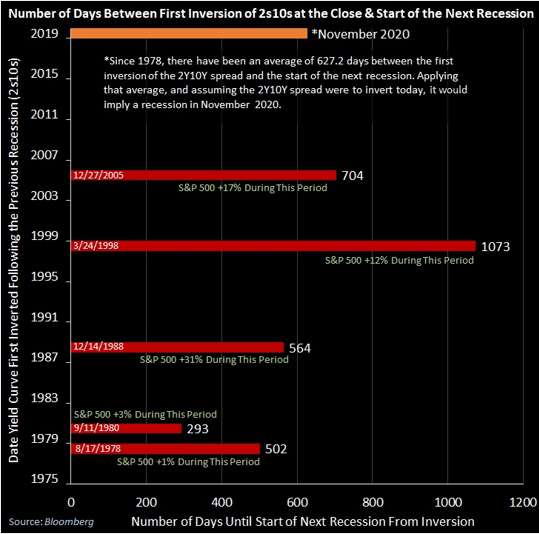

As far as recession indicators go, the inversion of the yield curve (when the 2 year treasury rate rises above the 10 year rate) is probably one of the most frequently cited. There’s a good reason for this: it has accurately predicted recessions dating back to before 1980 (minus a few false alarms).

However, as the 2 year rate is now within earshot of the 10 year rate (with just 15bps separating them), it’s worth keeping in mind that inversion does not imply an imminent recession. In fact, according to the chart below, the inversion of the yield curve predates the start of a recession by some 627 days on average. Should the yield curve invert this month, that would still mean that a recession would not be “predicted” to occur until November 2020.

Source: Bloomberg via Daily Shot, WSJ – February 21, 2019

PLEASE SEE IMPORTANT DISCLOSURE INFORMATION HERE.